GOVERNMENT FORMS

ADMINISTRATIVE COMPLIANCE

The following government agencies have ongoing mandatory reporting requirements for posts to maintain their nonprofit status, which makes them exempt from paying sales tax, property tax, and certain corporate taxes.

-

- The IRS

- California Secretary of State

- California Franchise Tax Board and

- California Attorney General

Maintaining a post’s nonprofit status with government agencies is an important part of the administrative compliance post leaders must maintain every year. Failure of posts to maintain administrative compliance with federal and state agencies is a big problem and can be very costly.

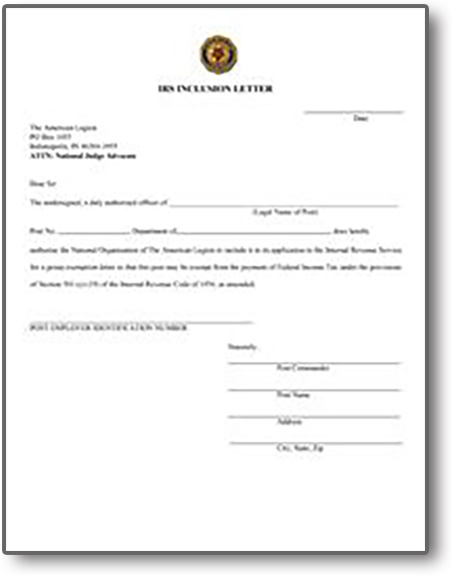

Most local posts in The American Legion have an IRS classification as a 501(c) 19 nonprofit. Nonprofits are held to a high standard of government regulation and public scrutiny. This is for good reason, as 501(c) nonprofits are exempt from federal corporate taxes and have access to public funding. These benefits are not typically available to for-profit businesses, so laws are in place to protect the public and ensure nonprofits do not abuse their financial privileges.

The consequences to a post and its leaders for not maintaining adequate books and failure to submit completed reports on time, are significant and potentially rather costly.

Outside of state and federal requirements, posts can also lose out on potential grants or large donations as a result of not maintaining their non-profit status with the IRS. A proactive approach to compliance helps ensure sustained success and the cost is small in comparison to the much larger costs associated with non-compliance.

Resources

- California Association of Nonprofits: Nonprofit Compliance Checklist

- IRS – Possible Consequences

- Automatic Revocation – How to Have Your Tax-Exempt Status Reinstated

- Tax-Exempt Organization Search

Use the Tax Exempt Organization Search tool to find information on an organization’s status.

Government Links to Find Post Status

Internal Revenue Service

https://www.irs.gov/charities-non-profits/tax-exempt-organization-search

Initial form or if status has been revoked: Form 1024

Annual requirement: 990 series

Change of address: Form 8822-B

Franchise Tax Board

Check your account status

Find out if your account with us is active or suspended:

Initial form or if status has been revoked: Form 3500

Change of address: Form 3533

Secretary of State: SI-100

Attorney General

(Not Secure) http://rct.doj.ca.gov/Verification

Initial Form: Form CT-1

** Annual requirement: Form RRF-1

** There is no annual filing requirement for Mutual Benefit organizations who have filed and been approved as “exempt” through the Attorney General’s Office.

Government Forms

Ensure your post submits these forms on time, as needed.

(A special “thank you” to District 22 for providing this information on government forms.)

IRS Form 8822B

Agency: Internal Revenue Service (IRS)

IRS Forms: IRS Form 8822B

Note: Any change in address or responsible party must be reported on Form 8822-B. This includes changes in post commanders.

Due Date: Contact IRS

IRS Form 990

Agency: Internal Revenue Service (IRS)

IRS Forms: Current Form 990 Series – Forms and Instructions

Instructions:

See Form 990 Thresholds to determine which form to file.

Then see Current Form 990 Series for instructions.

Due Date:

The 15th day of the 5th month following the end of the taxable year.

For most organizations, the tax year ends December 31 so the Form 990 is due May 15.

CALIFORNIA REQUIREMENTS

California Corporate Tax Exemption Renewals

Agency: California Franchise Tax Board (FTB)

Forms: Initially, Form 3500A submitted with an IRS Determination letter. Form 3500 if your status is revoked.

Agency Fee: $10

Dues: Annually within 4.5 months of your fiscal year end.

Notes:

Form 199: Exempt Organization Annual Information Return

Exempt Organizations List

Revoked Organizations List

The 15th day of the 5th month following the end of the taxable year.

For most organizations, the tax year ends December 31 so the Form 990 is due May 15.

California Statement of Information

Agency: California Secretary of State – Business Programs Division.

Forms: California Form SI-100: Statement of Information – Nonprofit Business Search

Filing Method: Mail, in-person, or online.

Agency Fee: $25

Due:

Biennially by the end of the month when the Articles of Incorporation were initially filed.

Can be submitted up to 5 months prior to this date.

Turnaround: Online version is filed in 1 business day.

Penalty: $50 late penalty.

Notes: We recommend online.

California Charitable Solicitation Registration

Agency: California Attorney General – Registry of Charitable Trusts

Form: Annual requirement: Form RRFF-1

Initial form: CT-1

Filing Method: Mail

Agency Fees: CT-1 = $25.00

RRF-1 = $0 to $300.00 depending on gross annual revenue

Dues: Renewal is due annually 4 months and 15 days after the close of your organization’s fiscal year.

If your fiscal year closes December 31, then renewal is due May 15.

Law: Section 12586 and 12587, California Government Code

11 Cal. Code Regs. section 301-307, 311, and 312

Penalties:

Failure to submit renewal on time can result in loss of tax exemption and assessment of minimum tax of $800,

plus interest, and/or fines or filing penalties. The Attorney General will notify the California Franchise Tax Board

to disallow your state tax exemption. Directors, trustees, officers, and return preparers are personally liable for

these fees and penalties – you cannot use charitable assets to pay them, they must be paid out of pocket!