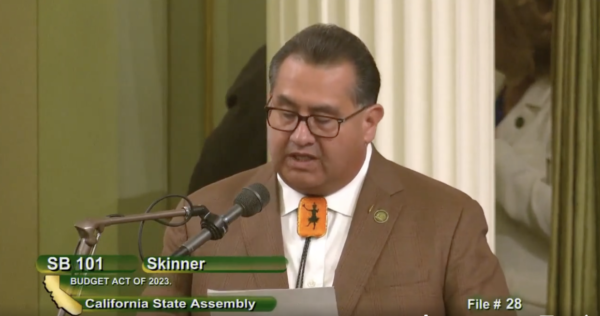

Assemblymember James C. Ramos, representing the 45th Assembly district, speaking in favor of the California state budget (Photo: Office of Assemblymember James C. Ramos).

In a recent development, Assemblymember James C. Ramos (D-San Bernardino) announced that Assembly Bill 46, a bill designed to exempt military pensions from state income taxes, will be delayed until the next legislative session.

The decision comes as the bill reportedly gained bipartisan support but faces opposition from the state’s Finance Department due to concerns about the long-term economic impact on California.

AB 46, if passed, would mark a significant milestone for military retirees and their dependents in California. The proposed legislation aims to provide them with state income tax exemptions, a privilege not yet extended in the Golden State despite previous attempts.

Assemblymember Ramos, recognized as the first and only Native American serving in the state’s legislature and the current chairman of the Assembly Committees on Rules, expressed his pride in the bill’s progress, highlighting its broad public support and unanimous bipartisan backing within the Legislature. He emphasized that AB 46 has never faced a single opposing vote. However, he acknowledged the challenging financial situation faced by California.

The decision to delay AB 46’s advancement comes as the state grapples with economic uncertainties, and Assemblymember Ramos is determined to navigate these fiscal challenges responsibly. He has pledged to collaborate with the Newsom administration to identify a sustainable funding solution while ensuring the bill ultimately reaches the governor’s desk for approval.

The bill, now placed in the Senate Appropriations Suspense file, will resume its journey next year, affording more time to solidify its financial foundation. Assemblymember Ramos views this collaborative approach as a positive step toward the bill’s eventual passage.

Would love to get an update on this bill. Ready to retire and would love to come back to CA, but without this bill passing, it makes if very tough.

https://www.thecentersquare.com/california/article_14d06ede-e975-11ef-8542-cf8d17e0a983.html

California spent 9.5 BILLION dollars on healthcare for illegal immigrants for the 2024-25 fiscal year! That is JUSTZ healthcare… not food, housing, etc. This is crazy! Can we take care of our own first?

Wow Adrian shocked me as a former enlisted that didn’t make it to retirement and probably has a nice high paying job with either the state or federal government or maybe with one of the over priced healthcare companies in California that are making it harder for those that cant afford medical. I am lucky to have my TRICARE to back me up. I figured that if I moved out of California it would be like getting a 5K raise per year at least. This bill would help to keep all retirees in the state which does have lots to offer.

We are considering moving from Midwest to California but are in sticker shock when we see what taxes we might have to pay on military retirement.

Sadly this should be a no brainer in todays society when the retired military keeps getting skipped over or money set aside for Vetarans get sent to countries in war at the moment and new comers are getting so much more help than the folks who have actually worked and paid taxes with no freebies given.

With so many people moving away from California we might be a little crazy to go live there and pay so much more than we do here.

Is there a contact in Congress we ca write to and express our feelings on this matter since it is affecting veterans?

I completely agree. We are a tiny piece of the California population, that is military retirees, something like 150K of us. If California did not tax my military retirement I would easily stay. They will make lots of money off my wife and my 401ks and taxable investments in retirement, along with sales taxes, vacation spending, and property taxes. Until then, I’m planning on moving in retirement in a few years.

Hello! Any update on AB46 now that it’s March 2024?

not shocked the bill is delayed. Cali being one of 3 states 3 that fully taxes pensions and is hemorrhaging people as they continue to tax everyone to death but will continue to allow illegal immigrants to flood in unchecked. while I applaud and was frankly shocked an elected official actually supported the military we all knew it was a pipe dream as a state with such a large military presence is the absolute least friendly in terms of supporting and providing for its active duty and retired service members. Once my working years come to an end I will relocate to a state more accepting of its veterans and allows me to survive and not live on the streets

It is unfortunate that a bill like AB46 may gather support when it is politically benefitable to politicians, however I presume will not be approved without further legislation which will reduce support for veterans. We however will support undocumented immigrants with vast funding that has no substantiated ROI. As a 26 plus year veteran, I worked in California and made a good living, but eventually the Quality-of-Life California presumes to provide my family and I is no longer sustainable. This bill is temporary at best. It has a limited shelf life and then expires. My perception is that California politicians are hoping that veterans will stay due to the temporary tax benefit will cause them to create a footing in California that will prevent them from desiring to move out of the state. If one would look at the average military retiree, they would see that their annuity is not a good match with California cost of living, thus the lack of larger populations of veterans residing in California when they retire. It is important to establish that most military retirees when they retire from the military have to continue to be employed in a second career to support they families. It is obvious that the rich can and are moving out of the state in large numbers. Companies are moving out of the state in mass. Is it not obvious companies are closing businesses due to the lack luster civilian population that has plagued them. Veterans are educated, well trained and provide quality citizens to California. Yes, continue to under value and ignore the veteran and we too will depart like so many others from the state we so dearly wish to reside in.

Well said!

I’m a retired naval officer who is a Minnesota resident. Currently there is NO Minnesota military pension tax. I split my time between Minnesota where I grew up and California where I own two homes.

If California exempts military pensions, I would immediately move my residence back here. This would allow the franchise tax board to tax my RMD, my rental income and my brokerage income. In my case, California is losing money on me by not exempting military pensions from taxation. I’m certain many more expats would move back permanently if this bill passes!!!!!

Additionally, I would spend much more time in California and thusly spend more money in California.

I don’t need to say more!

As an enlisted military retiree, I also was born, raised and have lived in California while not on active duty. I love California but the decisions by the law makers make me want to leave. Passing AB46 would help people like me. I see other laws helping homeless, giving medical care to non-US citizens, spending money to ensure green waste is thrown into the right container and wonder why the place I call home has a problem helping military retirees. Perhaps I need to be a plastic straw to be relevant in the California Legislation.

Vote yes on AB-46.

Either the bill gets passed or I find a new state to reside. Cost of living in Cali is just WAY TOO HIGH!

In the ongoing discussion surrounding AB46, there is an argument that veterans should “pay your taxes.” However, this argument overlooks the multifaceted challenges that veterans often confront. Military veterans have made tremendous sacrifices for their nation, and AB46 is a crucial step in ensuring they receive the support and recognition they rightfully deserve for their unwavering service. It is important to emphasize that this bill is not about veterans evading taxes but rather about offering essential financial relief to veterans grappling with the high cost of living in California.

When we compare California to other states that generously provide tax-free incentives to veterans, it underscores a compelling need for the Golden State to take similar measures. California boasts a substantial military population, and these veterans have dedicated their lives to serving their country.

They unquestionably deserve the same benefits and appreciation afforded to veterans in the twenty-five states that do not tax military retirement benefits. AB46 signifies a pivotal step towards aligning California with these states, thereby acknowledging the sacrifices and contributions of its military retirees.

While valid concerns about using enlisted members for propaganda and disparities between enlisted personnel and senior officers exist, it is essential to separate these concerns from the importance of AB46. This bill’s core purpose is to provide financial relief and support to veterans, regardless of any concerns related to military leadership. California now has an opportunity to demonstrate its unwavering commitment to veterans by enacting legislation that harmonizes with the practices of other states and acknowledges the invaluable contributions of its military retirees. It is high time for California to step up and support its veterans, just like other states. 🇺🇸 #SupportOurVeterans #AB46 #VeteranSupport 🇺🇸.

Overall, I believe AB46 is a positive step in the right direction. It would provide much-needed financial relief to veterans in California, and it would do so fairly and responsibly.

You can read this article for more insights: https://turbotax.intuit.com/tax-tips/military/states-that-dont-tax-military-retirement/L6oKaePdA

No matter how much support a bill like AB46 gathers, its never enough to have it pass. As a 30 year veteran, I work in California and make a good living, but eventually the cost of living here will drive veterans like myself away This bill would have helped keep some in California, but it seems that most California state legislators don’t really care that much about veterans or perhaps its just not that important to them.

It’s time to go. It is too expensive to live and sustain here. Home prices and property taxes are too high. It’s been nice California I hope the rich enjoy you. It’s used up warriors have no place here.

Can California afford to not pass this bill. Faced with a choice, military retirees will continue to move out of California instead of remaining in a state that is rapidly becoming unaffordable. And as they choose other landing spots, California will deprive itself of all of the great things retirees offer like steady and reliable income, technical skills, exemplary citizenship, and already provided healthcare. CA should revisit this decision to suspend this matter.

I support this bill 100% and it is way overdue. Veterans have sacrifice some much for our country and communities and so many other States already have this law established, California please take care of our military retirees.

It seems it is always fiscally responsible to send our Vets to war But sadly, while we have verbal bi-partisan support it is meaningless without action. Lots of words of support but there never seems to be any action.

B.S. pay your taxes

No you’re not all going to war. Having been prior enlisted Navy 14 years (Corpsman FMF) with multiple family members having served I know for a fact that many of our giving senior medical, dental and administrative staff just bide their time and do work arounds to wrap up 20-30 years takinig advantage of no tax home purchased in Southern California, using other states such as Illinois to call themselves residence when they live in California. They do 30 years driving down the I15 to San Diego to work in clinics or fly transport on the weekends. What really is astounding is how the propaganda machine puts the enlisted member front and center to the public when they want something to pass. While the senior officer crowd waits in the shadows looking to collect more generational wealth at hard working teachers, firefighter, nurses etc expense. Your contract was with the federal government not have anything to do with California.