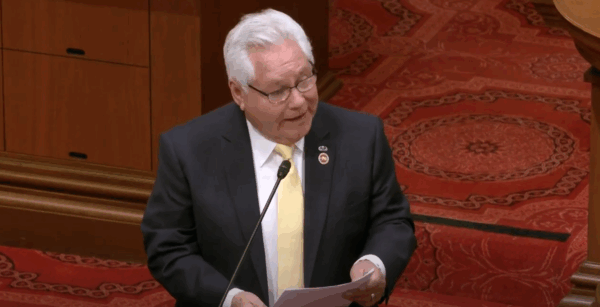

Senator Bob Archuleta concludes the California State Senate floor session, 2023 (Photo: CCC)

California Veterans with full service-connected disabilities could soon receive full property tax relief if Senate Bill 296, introduced by State Senator Bob Archuleta, becomes law. As reported by The Downey Patriot, the proposed legislation would exempt qualifying Veterans and their surviving spouses from paying property taxes on their primary residence.

Senator Archuleta, a U.S. Army Veteran and chair of the Senate Committee on Military and Veterans Affairs, introduced the bill to provide long-term financial relief to disabled Veterans across the state. He emphasized the importance of supporting those who have made immense sacrifices in service to the country, particularly as many Veterans live on fixed incomes and face high housing costs.

“This legislation is a matter of dignity and stability for those who have sacrificed the most for our state and the nation,” Archuleta said. “It’s time we do more to ensure our disabled veterans, many of whom are living on fixed incomes, are not left behind.”

Under the bill, Veterans who are rated 100% disabled due to service-connected injuries by the VA would qualify for the exemption. This includes Veterans who are blind in both eyes or have lost the use of multiple limbs. Unmarried surviving spouses would also be eligible under certain conditions.

If passed, SB 296 would take effect beginning January 1, 2026, and remain in place through January 1, 2036. The bill applies only to the primary residence of the Veteran or spouse, and prohibits recipients from receiving any additional property tax exemptions on that home.

California has the highest number of Homeless Veterans in the United States, with more than 11,000 living without stable housing. Senator Archuleta believes this bill could offer meaningful support by easing the financial burden on disabled Veterans and reducing their risk of housing insecurity.

“SB 296 is one step toward reducing homelessness and providing much-needed relief for those who honorably served this country,” he said.

The measure has received bipartisan support and mirrors similar legislation in states like Texas, Florida, Virginia, and Hawaii that already offer full property tax exemptions for qualifying Veterans. However, SB 296 does not include a provision for the state to reimburse local governments for the resulting loss in property tax revenue, which may present challenges for local budgets.

As the bill moves forward, Archuleta is encouraging residents to contact their state representatives and express support for SB 296. The bill is scheduled for a committee hearing on April 28.

Archuleta says this exemption honors disabled Veterans’ bravery and commitment to our nation and gives those struggling with California’s high cost of living a fighting chance to remain in their homes.